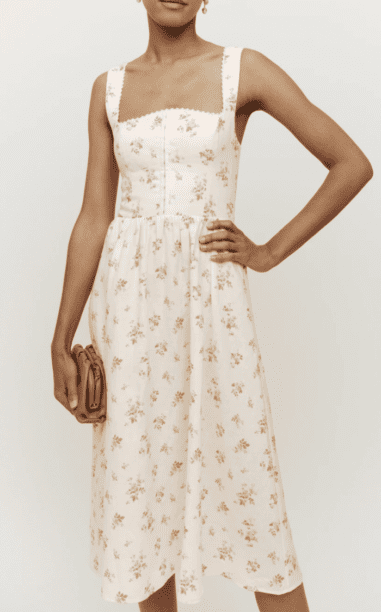

Robyn Dixon’s Green Printed Mesh Dress

Robyn Dixon’s Green Printed Mesh Dress / Real Housewives of Potomac Instagram Fashion August 2023

Robyn Dixon wore a fun green printed mesh mini dress for a girl’s night out on the town. She posted on Instagram that she had a great time at The Wharf in D.C. I also have had my share of fun there! The place is beautiful and the food is delicious. And thankfully Robyn has taken the guesswork out of what I should wear the next time I go back.

Best in Blonde,

Amanda

Click Here for Additional Stock

Photo: @robyndixon10

Spotted On Instagram

Latest Posts

Originally posted at: Robyn Dixon’s Green Printed Mesh Dress

Read More