Jenna Lyons’ White Cover Up

Jenna Lyons’ White Cover Up / Real Housewives of New York Season 14 Episode 9 Fashion

Jenna Lyons’ looks like a gorgeous goddess in her for day four two in Anguilla. Maybe it’s the tan she had to come early to achieve or maybe it’s the white cover up she’s wearing. Though I assume it’s a combination of the two and it’s working! I love a classic white cover up look, I think it’s a simple go-to that is sure to get that beach-y vibe. Which is why you should take a first class trip below to get one for yourself.

Sincerely Stylish,

Jess

More #RHONY S14 E9

-

Brynn Whitfield's Coral Dress and Round Chain Sunglasses

-

Jessel Taank's Printed Halterneck Skirt Set

-

Sai De Silva's Black Link Side Dress

-

Brynn Whitfield's Hot Pink Bikini

-

Erin Lichy's Green and Pink Tie Dye Bikini

-

Sai De Silva's Crochet Skirt Set

-

Jessel Taank's White Bikini

-

Sai De Silva's Crochet Coverup Skirt

Seen on #RHONY

Instagram By Request

-

Lisa Barlow's Icy Blue Outfit

-

Kyle Richards' Netted Cover Up and Chain Strap Swimsuit

-

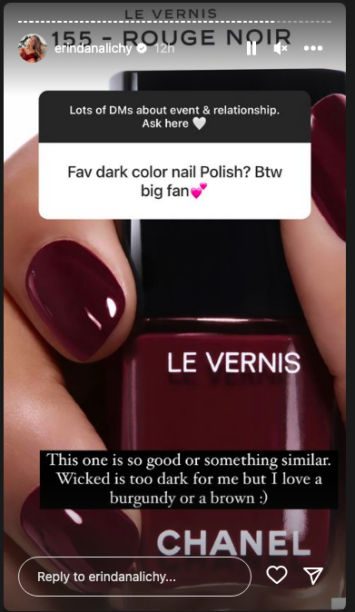

Erin Lichy's Favorite Nail Polish

-

Madison LeCroy's Brown Square Sunglasses

-

Ubah Hassan's Blue Midi Dress

-

Jessel Taank's Striped Flower Applique Crop Top

-

Lisa Barlow's Pink Shift Dress and Boots

-

Ciara Miller's Grey Satin Bustier Dress

-

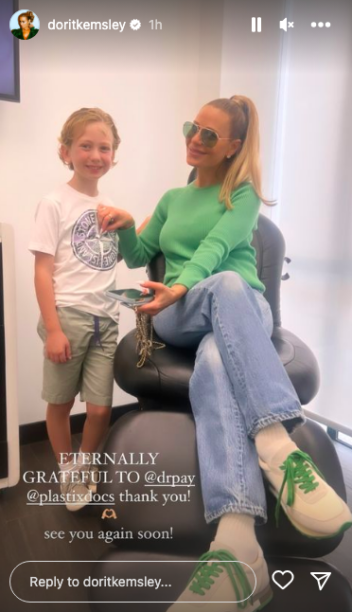

Dorit Kemsely's Blue Sweater and Sneakers

Latest Posts

Originally posted at: Jenna Lyons’ White Cover Up

Read More