Month: February 2025

11 Day Creams for Women Over 60

Posted by Admin01 | Feb 20, 2025 | Uncategorised |

Have you been using the same face cream for ages? Are you looking for something different? As we age our skin naturally changes, and it’s sometimes a good idea to switch up our skincare routine.

Here are some face creams you may want to consider:

- Olay Regenerist Micro-Sculpting Cream –Contains hyaluronic acid and peptides to help improve skin firmness.

- La Roche-Posay Redermic R Anti-Aging Moisturizer – Contains retinol and a blend of antioxidants to help improve skin texture.

- Kiehl’s Super Multi-Corrective Cream – Contains hyaluronic acid, jasmonic acid, and beech tree extract to help improve skin elasticity.

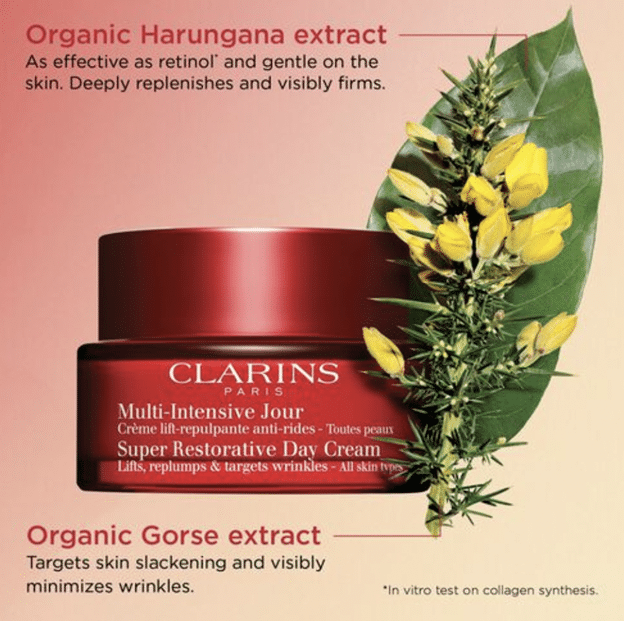

- Clarins Super Restorative Day Cream – Contains harungana extract to help replenish and firm mature skin.

- L’Oreal Paris Age Perfect Cell Renewal Rosy Tone Moisturizer – Contains imperial peony and lipo-hydroxy acid to help exfoliate and brighten the skin.

Continue reading to discover more day creams for mature skin.

Read Facial Peels: The Best Options for Women over 70.

What to Look for in Face Creams for Women Over 60

When looking for facial day creams for women over 60, it’s important to choose products that are specifically formulated to address the unique needs of our aging skin.

Here are some key ingredients to look for in day creams for women over 60.

Retinoids

Retinoids, such as retinol, can help improve skin texture and reduce the appearance of fine lines and wrinkles.

Hyaluronic Acid

This ingredient helps to hydrate the skin, reducing the appearance of dryness and fine lines.

Peptides

Peptides can help stimulate collagen production, which can help to firm and tighten the skin.

Vitamin C

Vitamin C is a powerful antioxidant that can help brighten the skin and reduce the appearance of age spots.

Niacinamide

This ingredient can help improve the skin’s elasticity and reduce the appearance of fine lines and wrinkles.

Read 10 Best Facial Cleansers for Women Over 60.

Face Creams for Women Over 60

Olay Regenerist Micro-Sculpting Cream

This cream contains hyaluronic acid and peptides to help improve skin firmness and reduce the appearance of fine lines and wrinkles.

La Roche-Posay Redermic R Anti-Aging Moisturizer

This cream contains retinol and a blend of antioxidants to help improve skin texture and reduce the appearance of fine lines and wrinkles.

Kiehl’s Super Multi-Corrective Cream

This cream contains hyaluronic acid, jasmonic acid, and beech tree extract to help improve skin elasticity and firmness.

Clarins Super Restorative Day Cream

This cream contains harungana extract to help replenish and firm mature skin, as well as hyaluronic acid to help hydrate and plump the skin.

L’Oreal Paris Age Perfect Cell Renewal Rosy Tone Moisturizer

This cream contains imperial peony and lipo-hydroxy acid to help exfoliate and brighten the skin, as well as nourishing oils to help hydrate and plump the skin.

Dermalogica Dynamic Skin Recovery SPF 50

This moisturizer contains peptides and hyaluronic acid to help improve skin texture and hydration, as well as SPF 50 to help protect the skin from further sun damage.

Avène PhysioLift Day Cream

This cream contains retinaldehyde, hyaluronic acid, and AscofillineTM to help improve skin texture and reduce the appearance of fine lines and wrinkles, as well as a blend of antioxidants to help protect the skin from environmental stressors.

Estée Lauder Revitalizing Supreme+ Global Anti-Aging Cell Power Creme

This cream features moringa extract, peptides, and hyaluronic acid to help enhance skin firmness, reduce the appearance of fine lines, and deeply hydrate for a radiant glow.

CeraVe Skin Renewing Day Cream with SPF 30

Formulated with ceramides, niacinamide, and encapsulated retinol, this lightweight cream restores the skin barrier, evens out texture, and protects against sun damage.

Neutrogena Rapid Wrinkle Repair Regenerating Cream

Packed with accelerated retinol SA and hyaluronic acid, this cream works to visibly improve fine lines, smooth texture, and boost skin hydration.

SimplyVital Collagen, Retinol & Hyaluronic Acid Cream

This cream combines collagen, retinol, and hyaluronic acid to hydrate, firm, and smooth the skin. Designed for the face, neck, and décolleté, it targets fine lines and wrinkles while improving overall texture. Made in the USA, it’s an ideal daily moisturizer for mature skin.

Remember, when choosing a facial cream for women over 60, it’s important to consider your individual skin type and concerns, as well as any allergies or sensitivities you may have. It’s always a good idea to patch-test a new product before applying it all over your face.

Read 7 BEST NIGHT CREAMS FOR WOMEN OVER 50.

Read 10 Best Cleansing Towelettes for Women Over 60.

Let’s Have a Conversation:

What day cream do you use? Is it on our list? Do you have a favorite face cream to recommend to our readers? Tell us about it in the comments below.

Read More

How Happy Do You Feel in Your Own Skin? Growing Old May Have Something to Do with It

Posted by Admin01 | Feb 19, 2025 | Uncategorised |

An old friend and I were chatting via email. She had sent me a photograph she had taken of me earlier that day. I replied that it made me notice how very white my hair is and that I needed a haircut. It also reminded me that I am not as slender as I used to be.

She

replied immediately to say I was “beautiful.” Which I am definitely not. I

suddenly realised that she thought I was one of those women who don’t much like

their own body and was seeking to reassure me.

I wrote

back to say I have never felt ugly nor beautiful, but “pretty enough,” and it

was not an issue for me. And she replied, “A rare and precious quality – being

happy in your own skin.”

This

stopped me in my tracks. Am I truly “comfortable in my own skin”? Do I feel

happy about myself? Is it, indeed, a rare quality?

Of

course, this has many meanings, but let us start with the physical one.

Physical Appearance

For

as long as I can remember, it never occurred to me to feel that my face or body

were not good enough. Yes, I was very short, but that couldn’t be altered

(aside from wearing high heels).

Yet

I didn’t feel the need to “fix” my body in some way. I never even liked wearing

makeup and, after a few inelegant efforts, gave that up. I was – and have

remained – a walking WYSIWYG (What You See Is What You Get).

It

was only when I got into my 20s or so that I discovered this was not the case

for all women. Many seem to feel their breasts are too large or too small,

their backsides are too big, their noses are not the right shape, and so forth

and so on.

And

so, of course, the business of makeup was born (going back to Egyptian times,

if not earlier) and, more recently, plastic surgery.

Much

is the advice given about how to alter your physical appearance – dying your

hair the right colour, doing the odd nip or tuck, and certainly applying loads

of stuff to your face. Even the right colours to wear for you.

But

does it make you happier, or indeed, more “comfortable in your own skin”? I

honestly don’t know. That is certainly the intention.

Deeper Issues

But feeling happy, or simply comfortable, with yourself is grounded in much more than your physical appearance. Do you like yourself? Do you think people like you? And do you feel you have done enough to meet your early expectations of yourself?

Our initial

view of ourselves must come from somewhere. This may be what our parents told

us or how we compared to our siblings. Much labelling goes on within families

“he’s the sporty one” or “she’s good with people” and this must rub off.

On

the other hand, it may not be fully accurate. I was the middle child of three,

with the other two being outstandingly clever. Despite reasonable grades in

school, it took me years to realise I was really quite bright as well. It

hadn’t seemed so, by comparison, in my formative years.

Our

view also comes from our classmates, not only in those many years of school, but

also if we go to university and beyond. We may get a reputation for studying or

partying or being good at politics. We may have loads of friends or very few.

As time passes, we try somehow to work out who we are and what we are good at. And how much do certain qualities and skills matter – to us or anyone else?

And

many a novel has been written about the rest of life! It has a way of throwing

you a hand-up or pushing you down. An abusive partner is very likely to flatten

self-confidence, just as a quiet but admiring one will do the opposite. Success

in work is much the same.

I

cannot do justice to the issue here, but it is all part of the process of

learning.

Feeling Happy in Your Own Skin

On

reflection, I feel this is a lifetime’s work; at least it has been for me.

It is one of the joys of growing older that year by year, you settle in, come to terms with your strengths and weaknesses, and accept yourself in a quiet way. You have achieved certain goals, but perhaps not others, and – it is hoped – accept your life for what it has been.

And

the important thing is that you view yourself not on the terms of your parents –

or your friends or colleagues – but on your own. It is the all-important bit of

“being old” that people don’t tell you about.

Also read, Looking and Feeling Young… Beyond 80!

Let’s Have a Conversation:

How happy do you feel with yourself and your qualities? What has helped you to reach this perspective? What would you advise others? Please share in the comments below.

Read More

Helping Adult Children Financially – Education

Posted by Admin01 | Feb 19, 2025 | Uncategorised |

Many parents help their adult children with education costs. Virtually, all parents pay for any K-12 costs. However, when it comes to post-secondary education, support depends not only on parental ability to pay but also on each family’s philosophy on how much cost older children are expected to cover.

This dynamic has been affected by surging education costs over time. When parents attended school, it was not unusual that many could say, “I worked my way through college.” Today, a much higher percentage of students need parental help.

Some ways parents can help their adult children with education costs are:

- Direct payments, including savings from 529 plans.

- Cosigning or paying off student loans.

- Paying for grandchildren’s education costs.

Direct Payments

The simplest option is for a parent to pay some or all of the student’s costs out of pocket. Payments can be made to the student, who then pays the costs, or the parent can pay the educational institution directly.

Paying the institution directly ensures the money goes toward bona fide education costs. Also, tuition expenses paid directly to a qualified educational institution are classified as an exclusion from gift tax calculations. However, this exclusion doesn’t apply to costs for items like books, supplies, and room and board.

529 Plans

Another way to pay for education expenses is a 529 plan. These plans were added to the federal tax code (Section 529) in 1996, with the 50 states and the District of Columbia administering the plans. Parents (or anyone else for that matter) saving money in a 529 account can withdraw the funds tax-free to pay for educational expenses. Each 529 is set up for the benefit of a specific student, so a parent saving for three children would have a 529 for each kid.

What Does It Cover?

Funds in a 529 plan can be used for costs like tuition, fees, and room and board. A 529 can also pay for registered apprenticeship program costs and student loan repayments of up to $10,000 for account beneficiaries. However, there are limitations on what types of expenses can qualify. For example, testing and application fees, transportation to and from school, health insurance, and extracurricular activities don’t qualify.

How to Open a 529 and What to Contribute

A 529 plan can be opened directly through a state or via a broker or financial advisor. There is no yearly contribution limit for 529 plans, but states place a cap on the total amount contributed during the life of the account, ranging from $235,000 to $550,000. Since the rules and fees of these plans differ by state, it’s wise to learn all the details for the state administering a 529.

Most 529 plans are the savings type. The other type involves prepaid tuition arrangements, which account for only 10% of all plans. Money deposited in a savings plan type is typically held in mutual funds, but other investments could include stocks, bonds, and guaranteed investment contracts.

Cons of 529 Plans

While there are terrific benefits for these plans, some disadvantages to 529 savings plans are:

Limited Investment Choices

Depending on the state, investment options may be limited in terms of variety or low-fee alternatives.

Lack of Uniformity Across States

The federal tax laws allow much flexibility in how states set up their programs.

Strict Plan Rules

Funds from a 529 plan are limited to a specific list of educational expenses. Should funds be misused, investment gains on the funds are taxed at the regular capital gains rates plus a 10% penalty.

Federal Student Aid Impact

When applying for financial aid, funds in 529 plans reduce a student’s eligibility to receive financial aid.

Potentially High Fees

529 plans differ in terms of fees, which reduce investment earnings, so it pays to compare fees between different plans.

Perhaps because of these disadvantages, only 20% of U.S. parents use or plan to use 529 plans to fund education. For lower-income parents, a 529 might not make sense anyway. A couple filing jointly would pay no long-term investment capital gains taxes if their modified adjusted gross income is below $96,700 (2025). Therefore, they would save just as well with a non-529 account.

Helping with Student Loans

Student loans are a popular way to pay for education; paying off the debt is burdensome for many.

For example, current student loan indebtedness stands at $1.74 trillion with an average monthly payment of $500, which the typical borrower will pay for 20 years.

As a result, many parents are motivated to help reduce the sting of student loans for their adult children in three ways:

Cosigning

Cosigning can help a student qualify for a loan, but it means the cosigner is on the hook if the student fails to repay the debt. Therefore, both the borrower and the cosigner must clearly understand the risks prior to taking this step.

Helping to Pay Off Student Loans

Another route a parent can take is to help the student make loan payments. However, before agreeing to do this, there are some important considerations.

Can You Afford to Help?

It’s important to realistically assess your ability to help with payments without jeopardizing one’s own financial health. Sacrificing retirement savings or putting off paying one’s own high-interest debt can be risky. The best strategy is to organize finances to maintain fiscal stability and then help with whatever funds are left over.

Make Payments Automatic

Make sure the way you pay is both efficient and effective. Consider setting up automatic withdrawals from a bank account to prevent missed payments.

Make Payments Before Graduation

Many student loans do not require payments to start until after a six-month grace period after graduation. However, since loan interest accrues from day one of the loan, a parent making payments before the end of the grace period can reduce the total debt.

Match Student’s Payments

A great way to share the payment burden is to match the adult child’s monthly payment. This could motivate the student to pay more than the minimum each month.

Help with Non-Loan Expenses

Helping with other expenses like groceries or a cell phone can free up funds for the student to make loan payments.

Loan Payments as Gifts

Consider making loan payments as holiday or birthday gifts. Also, if a parent receives a windfall like a work bonus or unexpectedly high tax refund, these funds could be directed to loan payoff without jeopardizing the parent’s regular financial obligations.

Refinancing/Consolidation

If the student has federal loans, a consolidation loan might help. If refinancing private loans is an option, a parent could cosign, thereby reducing the interest rate and helping with payments.

Taking Out a Parent Loan

One of the most profound commitments a parent can make is to take out a parent student loan. According to Sallie Mae, a public corporation that handles private student loans, about one-fifth of parents borrow to pay education expenses. A federal option is the Parent PLUS loan. There are also private parent student loans. Other alternatives are home equity loans and borrowing from a 401(k).

Paying for Grandchildren’s Education

One way parents can support their adult children on the education front is to provide funds for grandchildren’s education. The assumption is that adult children’s finances are freed up by helping with grandkids’ education expenses.

Ideas for doing this are:

Set Up a 529 for Grandchildren

As noted above, there are no restrictions on who can set up a 529 plan for a given beneficiary.

Paying for Preschool

Funds for preschool tuition are excluded from gift tax calculations. This applies only to preschools qualifying as educational institutions, not regular daycare providers. On the other hand, if a grandparent’s annual contribution to preschool or daycare is under $19,000 for 2025, then no gift tax paperwork is required.

Helping with Student Loans

If grandkids are college-age, most of the ideas noted in the section above apply to grandparents who want to help pay or cosign for student loans.

Helping to pay for education is one of the most satisfying ways a parent can help their adult children get ahead in life. However, it needs to be done with eyes wide open to all the options available and implications for the parent’s finances to ensure the best decisions for both student and parent.

Read the previous articles in this series here.

Let’s Have a Converstion:

Have you helped your children with educational expenses? Which route did you take? Are you now helping with grandchildren’s education?

Read More

Recent Posts

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- April 2015

- January 2015