I was devastated. A few days before I turned 60, I was suddenly a widow. But really, I was typical. Surprisingly, the average age at which a wife becomes a widow is 59.4.

About 1 million women a year in the U.S. experience what may be the most stressful event in their life. With almost 16 million widowed persons in the country today, 77% are female.

The death of a spouse brings on a flood of financial responsibilities, further complicating matters. Because their husbands frequently handled significant money issues, many widows aren’t as familiar with investing, insurance policies, taxes, or estate planning, even though they may have managed day-to-day household finances well.

New widows are likely overcome by grief and despair initially. As a result, financial issues might get pushed to the side.

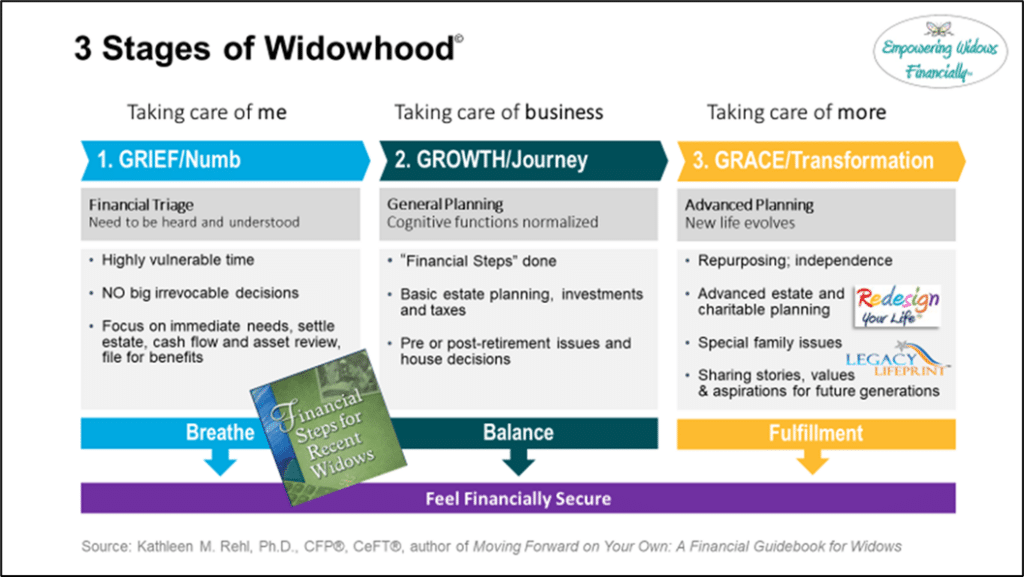

Stages of Widowhood

In my prior experience as a financial advisor and researcher, I’ve observed three stages that widows travel through, including myself. It’s been 15 years since my late husband died, and I’m still on my journey. The graphic below summarizes these three stages:

Stage 1: Grief

This stageis a numb period when a widow realizes her husband is gone forever. Her grief can resemble what some call a “brain freeze.” Weak memory, short attention span, and trouble with decision-making are typical. My Social Security number eluded me. Where did I put my car keys? I questioned whether I was crazy. I wasn’t. I was simply a grieving new widow.

Widows can benefit from focusing on self-care, with supportive listening by others to help stabilize their situation. This stage can be a precarious time. Widows may become ill, especially if they were a primary caregiver for an ailing spouse. Only take necessary action and delay making major, irrevocable financial decisions.

She may refer to her thinking as “Jelly brain.” It’s a vulnerable time. Significant decisions like moving from her home immediately should be delayed. Some critical financial issues will need attention, including applying for Social Security benefits if applicable, getting a picture of her cash flow situation, making sure bills are paid, applying for death benefits, knowing a broad view of her financial assets, and more.

It’s a time to breathe, to use a yoga term. The day I picked up my husband’s ashes from the mortuary was also the day I started my first yoga class.

A woman can face a double whammy after her spouse’s death if her knowledge of financial matters isn’t strong and her emotions are raw. Here are five suggestions for new widows after their partner’s passing:

- – take your time.

- – selling inappropriate investments.

- – don’t move to escape memories.

- – it’s different now.

- – including family, friends, and new “boyfriends.”

By the end of Stage 1, most widows will want to focus on financial actions outlined in Financial Steps for Recent Widows, a free eBooklet on my website.

Stage 2: Growth

Growthis when the widow is ready to consider more broad-based financial planning matters once she can think more clearly. A widow will make necessary updates to her estate plan, assess the possibility of repositioning investment holdings, and monitor her tax situation. Housing decisions are essential before and after retirement, including whether to stay or move. In the words of a yoga proponent, it is a time of balance.

Moving from Stage 1 to Stage 2 is not a straightforward linear progression. Sometimes, progress is two steps forward and one step back. Or move three steps around and one ahead.

Unfortunately, some widows don’t move past the first stage but stay in grief. The phrase “staying stuck” has been used to describe them. They were “joined at the hip” with their spouse, doing everything together, and are typically elderly. They may pass away within a few years of their partner’s death. You’ve probably heard stories of couples dying, sometimes just a few days or hours apart. A surviving spouse might soon die from heartbreak. Research validates this “broken heart syndrome.”

So how long does it take to go from that grief stage to the growth stage? That depends on several factors. For example, a sudden and unexpected death, like a 60-year-old fellow on the tennis court, would be much different from the 89-year-old husband who died peacefully in his sleep.

The older gentleman had lived “on borrowed time” for several years with dementia, according to his widow. She started her grieving process even before her husband died. She moved from Stage 1 to Stage 2 in six months. However, the tennis husband’s wife took almost a year to transition. Each widow’s journey is different. Indeed, for some widows, that middle stage is a comfortable place, and they may be content to remain there.

In a future article, I’ll say more about specific financial actions in this second stage of widowhood.

Stage 3: Grace

The third stage is the stage of grace, or as some prefer to call it, transformation. It took me five years to get there; as I wrote in my journal one day, “I’m much more than a widow. I am an independent woman!”

This stage can be beautiful when a widow’s new life evolves with reinvention, renewal, and repurposing. There can be new people, new experiences, and new opportunities. It’s a time of taking care of more. These women often enjoy advanced planning concepts, such as legacy and charitable planning related to family and others they love. It may involve a new business or hobby. New friends and new communities are possible. There may even be a new romantic love.

In an upcoming article about Stage 3, I’ll share how widows can lead a fulfilling, rich, and rewarding life after the death of their spouse. That includes my personal story, 15 years after my late husband’s death. Stay tuned!

Let’s Have a Conversation:

If you’ve experienced widowhood, what stage are you at now, and how is life going for you? If your mother, aunt, sister, daughter, cousin, or friend is a widow, what have you learned by observing their journey? Please share your responses with our Sixty and Me community.